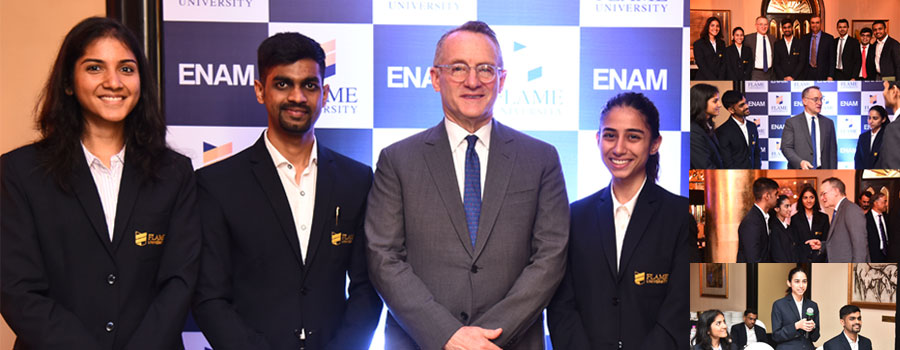

Howard Marks addressed a crowd of investment enthusiasts including some FLAME University students at a value investing knowledge series event held by ENAM Holdings in Mumbai on March 2, 2017. Not only were our students absolutely thrilled to meet someone of his stature, but also Mr. Marks showed keen interest in interacting with them. He answered their questions in the most simplistic manner without using technical jargon which made the session even more interesting for the students.

Howard Marks is an American investor and writer. After working in senior positions at Citibank early in his career, Marks joined TCW in 1985 and created and led the High Yield, Convertible Securities and Distressed Debt groups. In 1995, he left TCW and co-founded Oaktree Capital Management.

He is known in the investment community for his ‘Oaktree memos’ to clients which detail investment strategies and insight into the economy. He talked about his investment philosophy that he has discussed at length in his book: “The Most Important Thing: Uncommon Sense for the Thoughtful Investor”. It was great to hear the timeless principles that have worked for him over 21 years at Oaktree.

To be a successful investor, you have to have a clear philosophy and stick to it even under pressure. No one can profit from all opportunities. To be a disciplined investor, you have to be willing to stand by and watch others make money. Your process is more critical than the outcome. Talking about the investing profession, he said that no one can consistently forecast. Our industry is full of people who become famous by getting it right once. Investors would be wise to accept that they can't see the future and restrict themselves to doing things that are within their control. While we can't see where we are going, we ought to have a good sense of where we are.

He insisted that the most important criteria for an investment firm’s success is that all team members should have the same investment framework and value system. The skillsets have to be and complementary. Otherwise there are challenges over the long term. The partners at Oaktree are so closely aligned with each other that they have never had to take a vote in 21 years.

Explaining about market bubbles, he spoke of how his firm has been successful in identifying the three large bubbles in the last three decades by avoiding excesses. They don’t know the timing of the bubble, but when they see over-generalization in the market (Eg. “tech stocks are not expensive at any price” or “mortgages are risk free investments”), they think it’s time to be very cautious. If the market seems frothy, the level of discipline must go up. Markets are not always efficient. It cannot be assumed that bargains in the past, will be available in the future.

He shared some lessons he has learnt in this investing career. He urged the audience to ask themselves, “how much optimism or pessimism is already factored into this price”, before making an investment. He further emphasized that buying good companies DOES NOT EQUAL buying companies well. The entry price is the most important criteria for making any investment decision, be it a high quality company or a junk bond. At the right price, even a junk bond is AAA.

He mentioned that his skepticism is an asset as he believes that if something is obviously great, it’s not the best bargain. No good investor is 100% sure of the future. You have to be unsure and skeptical. It is essential to invest counter-cyclically. Cyclical ups and downs don't go on forever, but at extremes most act as if they will. Markets are riskiest when there is widespread belief there is no risk, which was the case in 2007.

“I am always worried when I make an investment decision. That’s the only way there is. You can never be totally confident of a thesis“, he said, explaining the state of mind of a good investor. “Investing is like being an airline pilot – hours of boredom punctuated by moments of terror”, he exclaimed.

He also explained how sometimes it’s better to not act than act impulsively just because one thinks there needs to be some action. “When there is nothing clever to do, mistakes lie in trying to do something clever”, he said while explaining the human tendency to act when it may not be required. Sometimes there are plentiful opportunities giving unusual returns; wait patiently for such opportunities. Big gains come when consensus underestimates reality. Be aggressive at bottoms, defensive at highs. Key to outperformance is to think different, and to think better. Superior returns come not from being right, but being right more than others. Superior results don't come from buying the right asset, but from buying assets at less than their worth. Investing is not about what you buy, but what you pay.

He defied the common belief that high risk equals high return. He strongly advised, “High risk DOES NOT EQUAL high return. If high risk means high return, then it’s not high risk by definition. In fact, in investing, LOW risk equals HIGH return.” One must always think of the downside or the worst case scenario. If one avoids the downside, the upside will take care of itself. Giving an analogy of tennis, unless one is a professional tennis player, avoiding unforced errors is more important than hitting aces. If one concentrates on keeping the ball in play, one will win.

Mr. Marks elaborated that over the last few years, investor timeframes have shrunk, obsessed with quarterly returns. It is to one’s advantage to be right in the long run. Risk is inescapable in investing, but you should not expect higher returns, just by taking on more risk. Risk needs to be controlled but not through quantification; experienced qualitative judgment is better. Investing cannot be reduced to an algorithm or mechanical process. Good performance will result in inflows, but if inflows are not checked it may lead to bad performance.

He sincerely advised investors to be unemotional and to read anything and everything one can lay their hands on as it always helps in making better investment decisions.

Currently, he is writing his second book which is on asset selection and market cycles and will be out this year.

It was an amazing experience to hear such an investment legend speak. We are very thankful to Mr. Howard Marks for interacting with our students and giving them some valuable insights.